Three Pillars of Strategic Finance Maturity for CEOs & CFOs

Articles

January 12, 2026

Table of Contents

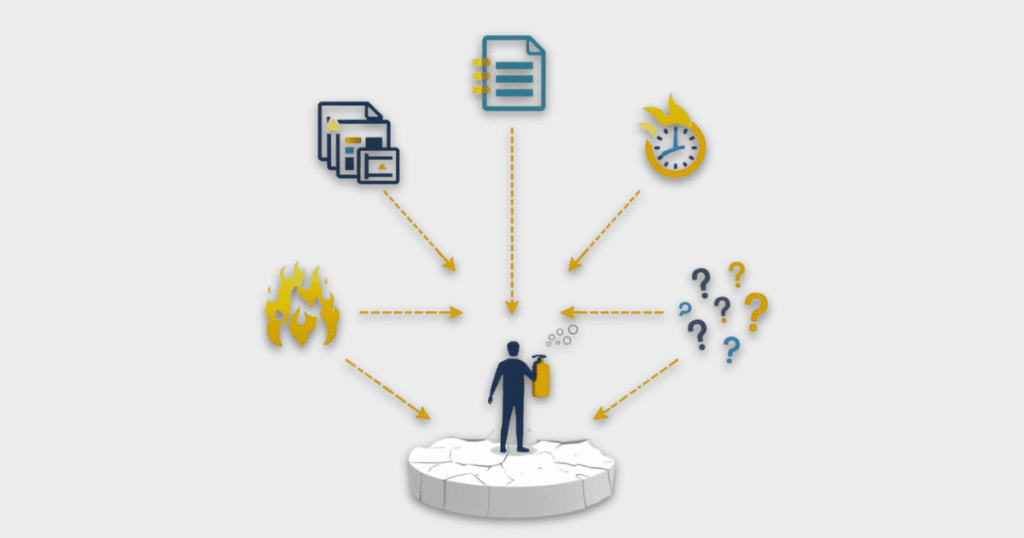

Businesses often struggle not from a lack of effort but because their finance function is not designed to provide clarity, generate insights, or support growth. These challenges consistently manifest as three distinct, yet interconnected, “blind spots” that represent stages of financial maturity.

- The Clarity Problem: The finance engine is unstable. Data exists but is unreliable, leading to a lack of trust in the numbers. This foundational issue prevents confident decision-making.

- The Insights Problem: The business possesses data but lacks direction. Financial reporting describes past events without explaining their drivers, rendering finance a reactive scorekeeper rather than a strategic partner.

- The Growth Problem: Ambition for scale outpaces the financial infrastructure’s ability to support it. Weaknesses that were manageable at a smaller size become significant risks, deterring investors and undermining leadership confidence.

These are sequential problems.

True insights cannot be generated without first establishing clarity.

Likewise, sustainable growth is impossible without the direction provided by insights.

The core challenge for most companies is having accounting without clarity, data without insights, and ambition without the financial readiness for growth. The proposed solution involves systematically addressing these pillars through structure and strategic financial thinking to transform finance into a system that provides clarity, direction, and confidence.

The Three Finance Blind Spots

An analysis of businesses across various sizes and industries reveals that finance-related problems consistently fall into three categories. Each problem corresponds to a different stakeholder’s reality and represents a critical stage in the development of a mature finance function.

1. The Clarity Problem (The CFO & Finance Team’s Reality)

This foundational issue revolves around the integrity and reliability of financial data. The core reality is that the finance team is perpetually busy but not truly in control, working with data that cannot be confidently trusted.

What’s Really Happening:

- Data is available, yet it remains unreliable.

- Numbers exist, but they lack the integrity for confident decision-making.

Typical Symptoms:

- Lack of a Single Source of Truth: Multiple, conflicting versions of financial numbers circulate within the organization.

- Incomplete Accounting: While accounting is technically “done,” balances fail to reconcile cleanly.

- Prolonged Month-End Close: The closing process is extended by the need for manual fixes and last-minute adjustments.

- Reactive Audits: Audits become firefighting exercises focused on resolving issues rather than validating sound processes.

- Constant Surprises: Unexplained variances, corrections, and reversals appear in every reporting period.

- Process Deficiencies: Financial closures depend on the memory or transactional grip of a single individual rather than on a robust, repeatable process.

- Inefficient Use of Time: Finance teams spend more time on reconciliation tasks than on value-added analysis.

- Ineffective Controls: Financial controls exist on paper but are not effectively executed in practice.

Implications: When a business cannot trust its own numbers, every decision built upon that data is inherently fragile. Clarity is not merely about completing accounting tasks; it is about achieving accuracy, timeliness, repeatability, and confidence in the financial reporting.

In Simple Terms:

The finance engine is running, but it’s unstable.

2. The Insights Problem (The CEO & Leadership Team’s Reality)

This problem emerges when a business has data but cannot translate it into actionable direction. The finance function produces reports, but these documents fail to answer the critical questions that leadership needs to guide the business strategically.

What’s Really Happening:

- The business has an abundance of data but no clear direction derived from it.

- Reports are generated but do not address the primary concerns of the leadership team.

Typical Symptoms:

- Unreliable Reporting: Management Information Systems (MIS) exist but are delayed, inconsistent, or unreliable.

- Lack of Explanatory Power: Reports describe past performance but do not explain why results occurred.

- Absence of Deep Analysis: There is no structured variance analysis or understanding of business drivers at a granular level.

- Obscured Profitability: The profitability of individual products, customers, or channels is unclear.

- Poor Cash Flow Visibility: Cash flow surprises are common, indicating a weak grasp of liquidity.

- Siloed Information: Financial and operational data exist in separate systems and are not integrated.

- Opinion-Based Debates: Leadership discussions are based on opinions and assumptions rather than on objective facts.

- Lack of Financial Discipline: The organization lacks a formal discipline for budgeting, forecasting, or scenario modeling.

Implications: In this state, the finance function is relegated to the role of a scorekeeper, not a strategic partner. This leads to reactive decision-making, missed opportunities, and the late – and therefore expensive – addressing of critical problems.

In Simple Terms:

You have numbers, but they don’t lead to decisions.

3. The Growth Problem (The Founder, Board & Investor Reality)

This issue arises when a company’s ambition to scale is hindered by a finance function that is unprepared for the demands of growth. Expansion amplifies financial and operational weaknesses that were previously manageable.

What’s Really Happening:

- The business has clear intentions to scale, but its finance function lags behind and cannot support this objective.

- Growth exposes and magnifies foundational weaknesses in financial systems and processes.

Typical Symptoms:

- Inadequate Stakeholder Reporting: No board- or investor-ready reporting structure is in place.

- Weak Financial Models: Models fail to clearly explain unit economics or the scalability of the business model.

- Lack of Stakeholder Clarity: The cap table, ESOPs, and other stakeholder structures are not clearly defined or managed.

- High-Risk Capital Events: Fundraising and due diligence processes become high-risk exercises due to financial disorganization.

- Unsupported Valuations: Valuation discussions lack the backing of a credible and compelling financial narrative.

- Unscalable Systems: Existing processes and systems cannot handle increased volume, complexity, or geographic expansion.

- No Strategic Financial Roadmap: There is no long-term financial plan that is aligned with the company’s growth strategy.

- Disconnected KPIs: Key Performance Indicators exist but are not linked to value creation or strategic execution.

Implications: When the finance foundation is weak, growth becomes a risky endeavor instead of a strategic one. This causes investors to hesitate, negatively impacts valuations, and erodes leadership’s confidence in making forward-looking decisions.

In Simple Terms:

Ambition exists – but the finance foundation can’t support it.

An Interconnected Framework for Finance Maturity

These three problems – Clarity, Insights, and Growth – are not isolated issues. They are sequential stages of finance maturity that are fundamentally interconnected. A business cannot successfully navigate one stage without mastering the previous one.

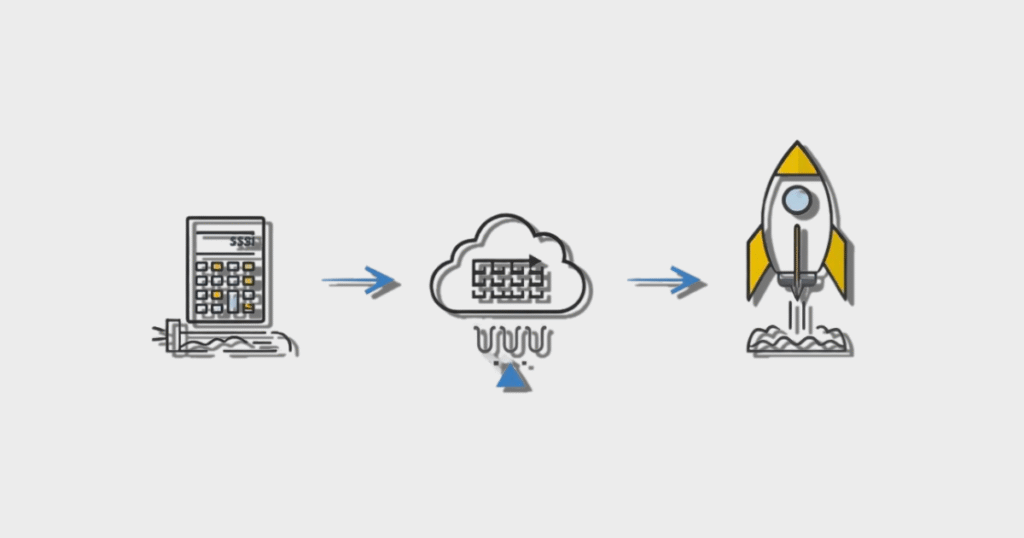

The progression is hierarchical:

- Clarity is the Foundation: Until the core financial data is accurate, timely, and reliable, any attempts to derive insights will be flawed.

- Insights Drive Strategy: Until the business can convert clear data into actionable insights, any attempt at strategic growth will be undirected and likely to break the system.

This framework reveals the underlying condition of most companies:

- They have accounting, but not clarity.

- They have data, but not insights.

- They have ambition, but not growth readiness.

Vireon Solution Framework

Vireon model is designed to help businesses systematically master these three pillars of financial maturity. The approach focuses on transforming the finance function from a liability into a strategic asset.

Core Objectives:

- Fix the finance engine: Establish CLARITY by ensuring data is accurate, repeatable, and trustworthy.

- Convert data into decisions: Generate INSIGHTS by analyzing data to provide direction and answer critical business questions.

- Build finance foundations that support scale: Enable GROWTH by creating scalable systems, processes, and strategic financial roadmaps.

This is achieved not through generic reporting, but through the implementation of structure, discipline, and strategic financial thinking. The guiding principle is that finance should not be a function that slows a business down; rather, it should be the system that brings clarity, direction, and confidence to every decision.

Ready to See What's Really Going On in Your Numbers?

Book a 30-minute call with our founder – no fluff, just clarity

Subscribe to the Vireon

Newsletter

Get business clarity, strategic insights, and finance tips straight to your inbox.

Related Posts