Forecasting for Founders: Simple System to Predict Revenue, Margins & Cash Flow

Articles

December 02, 2025

Table of Contents

Forecasting often feels like an overwhelming task for founders, finance leaders, and CFOs. The complexity of predicting revenue, margins, and cash flow can lead to analysis paralysis – where overthinking stalls action. Yet, mastering forecasting is critical. It empowers leaders to anticipate challenges, seize opportunities, and drive sustainable growth with confidence.

Why Forecasting Matters for Founders

Forecasting isn’t just about numbers; it’s about foresight. For founders, understanding how much revenue will come in, what margins to expect, and when cash will flow is foundational to making strategic decisions – from hiring and marketing spend to product development and capital management. Without a clear forecast, decisions become guesses that can jeopardize growth and financial stability.

A Simple, Practical Forecasting System

You don’t need complicated models or endless spreadsheets to forecast effectively. Here’s a straightforward system that any founder can implement:

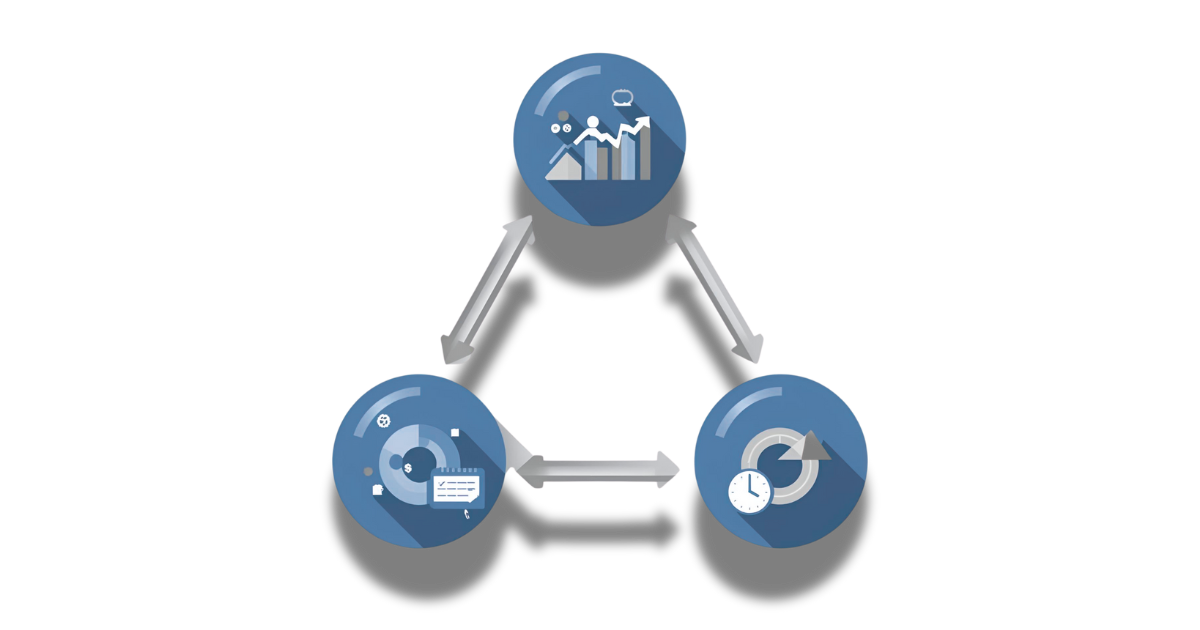

- Revenue Drivers: Identify your core revenue streams and the key metrics that influence them – for example, number of customers, average transaction size, or subscription renewals. Use historical data to set realistic assumptions for growth or contraction.

- Margin Mapping: Understand your gross margins by product or service line. Calculate direct costs, variable expenses, and allocate overhead proportionally, so you know the true profitability behind each revenue source.

- Cash Flow Timing: Map out when money moves in and out – including payment terms, supplier schedules, payroll cycles, and capital expenditures. This highlights timing gaps that impact liquidity and working capital.

By breaking forecasting down into these core components, founders can build clear, actionable projections without getting lost in complexity.

Integrating Forecasting into Business Rhythms

Make forecasting a living tool, not a once-a-year exercise:

- Update monthly or quarterly to reflect real-world changes.

- Use rolling forecasts that look 12-18 months ahead, allowing flexible planning.

- Incorporate scenario planning to test responses to different market conditions or growth strategies.

How Automation and Tools Amplify Accuracy

Manual forecasting is prone to errors and consumes precious time. Modern automation tools streamline data gathering, reconcile discrepancies, and generate real-time dashboards. This not only improves forecast accuracy but frees founders and finance teams to focus on interpreting data and making strategic decisions.

Real Impact: Forecasting Drives Growth

Founders who adopt simple yet disciplined forecasting report clearer visibility into business health, better cash management, and informed prioritization. One SaaS startup founder credited rolling forecasts and margin tracking with enabling confident investment in customer acquisition – leading to a 50% revenue increase within a year.

Forecasting Made Simple and Strategic

Forecasting doesn’t have to be complex to be powerful. By focusing on revenue drivers, margin clarity, and cash timing in a simple system, founders gain the foresight necessary to lead with confidence and agility. Automation and continuous updates enhance this foundation, transforming forecasting from a daunting task into a strategic advantage.

FAQ

What’s the difference between basic forecasting and FP&A?

How often should founders update forecasts?

Can automation really simplify forecasting for startups?

Mastering forecasting with a simple, repeatable system empowers founders to navigate uncertainty and scale sustainably. Partner with Vireon to modernize your financial planning and drive your growth agenda with confidence.

Ready to See What's Really Going On in Your Numbers?

Book a 30-minute call with our founder – no fluff, just clarity

Subscribe to the Vireon

Newsletter

Get business clarity, strategic insights, and finance tips straight to your inbox.

Related Posts